Turn an Idea into a Plan (Free)

Download a startup business plan template, define your market, and outline spend. Lenders and grant reviewers prefer founders who can quantify demand and list specific startup business costs before borrowing.

Make It Real—Fast & Cheap

- Form an LLC online for < $100.

- Request a free EIN (critical for startup business credit cards with no credit EIN only).

- Open a business checking account and quote startup business insurance.

- Create a D‑U‑N‑S® number to build business credit.

Funding Paths That Ignore Your FICO

Grants & "Free" Money

- Federal & state startup business grants (SBIR/STTR, veteran, minority, and rural programs).

- City "micro‑enterprise" small business startup grants.

- Private challenges from Amazon, FedEx, Shopify.

Micro & Community Loans

- Kiva, Accion, CDFIs—perfect for loans for a business startup under $15k.

- Many approve startup business loans with bad credit or no collateral.

Fintech No‑Doc Lending

- Easy approval startup business loans that analyze projections, not tax returns.

- Guaranteed startup business loans no credit check up to $25k.

- Startup business loans with no revenue + bad credit (expect higher APRs).

Credit Cards That Build EIN‑Only History

- No‑personal‑guarantee startup business credit cards.

- Secured cards that "graduate" after six months of on‑time payments.

Lines of Credit & Equipment Loans

- Unsecured business line of credit for startup leveraging projected invoices.

- Equipment loan for startup business—great for a lawn‑care kit or commercial kitchen.

Approval Hacks

- Match product to phase: idea → grant; MVP → micro loan; early revenue → business line of credit for startup.

- Stress‑test payments with a startup business loan calculator.

- Stack small facilities instead of one giant note.

- Keep utilization < 30% to unlock the best startup business loans.

Five Common Startup Costs

| Cost Category | Examples |

|---|---|

| Formation & Legal | LLC fees, lawyer for business startup |

| Licensing & Insurance | Permits, startup business insurance |

| Equipment | Vans, tablets, or a non‑medical home health startup business package |

| Marketing & Website | Online business startup tools, social media |

| Initial Payroll | Employees or contractors |

2025 Founder Checklist

- ✅ EIN & bank account

- ✅ Finished business plan for startup

- ✅ Budgeted startup vs small business costs

- ✅ Applied to ≥3 grant programs

- ✅ Quoted two startup business loans bad credit no collateral

- ✅ Opened a credit card for startup business

Mini Case Study: Phoenix Care

Sofia, a Navy veteran, launched Phoenix Care in April 2025:

- $3k VA grant → tablets for caregivers.

- $12k startup loan for new business via CDFI (FICO 610).

- $7.5k equipment loan for startup business → mobility van.

- Now serving 18 clients; revenue climbing 20% MoM.

Key Takeaways

- No money ≠ no options. Grants, micro loans, and EIN‑only credit build momentum.

- Layer funding. Combine small facilities to minimize risk.

- Plan obsessively. A rock‑solid business startup checklist shortens approvals.

If your startup business is looking for ways to get funded this year, start with grants, layer in micro debt, and graduate to larger lines once revenue flows. Your future customers—and lenders—are waiting.

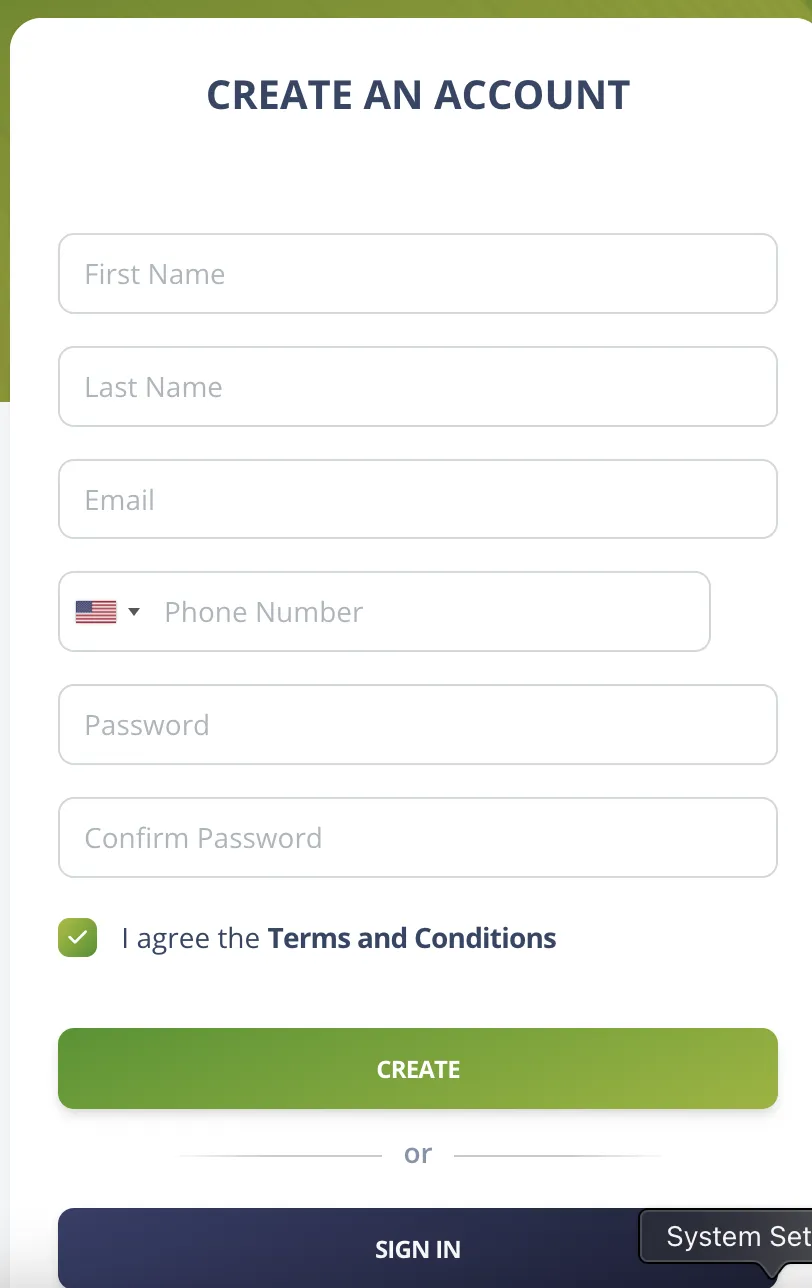

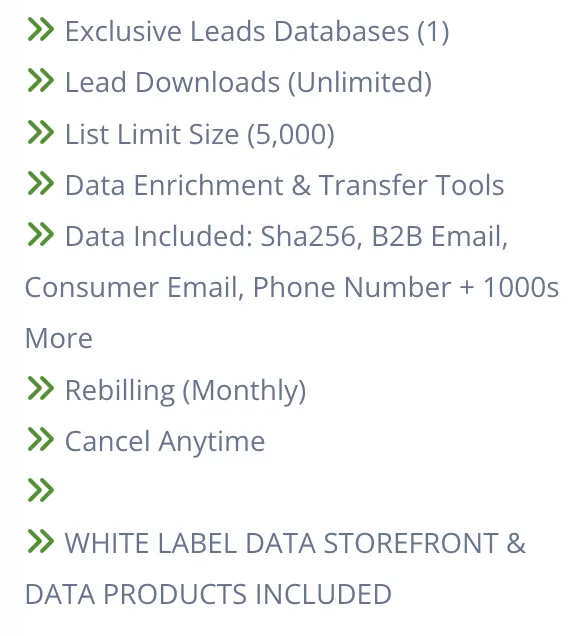

Access Funding Resources