Jamie Dimon - CEO of J.P. Morgan Chase Bank

James “Jamie” Dimon (pronounced DY-mən; born March 13, 1956) is an American executive who has served as chairman and CEO of JPMorgan Chase since 2006. Early in his career, he was a consultant at Management Analysis Center, then joined American Express under Sandy Weill after completing his MBA at Harvard Business School in 1982.

By age 30, Dimon was finance chief at Commercial Credit, soon becoming its president. He took on leadership roles at Travelers and Smith Barney and rose to Citigroup’s presidency in 1998. In 2000, he moved to Bank One as CEO, guiding it through operations until a merger with JPMorgan Chase in 2004; two years later, he transitioned to CEO of JPMorgan. At different points, Dimon also served as a board director for the Federal Reserve Bank of New York. His name has repeatedly appeared on Time magazine’s roster of the 100 most influential individuals worldwide. As of January 2025, Dimon’s net worth was valued at around $2.8 billion.

Early Life and Education

Jamie Dimon was born in New York City and spent his youth in Queens, specifically in Jackson Heights. His parents, Theodore and Themis Dimon, shared Greek heritage. His paternal grandfather was originally from Greece and had worked in banking before moving to the United States, shortening the surname from “Papademetriou” to “Dimon.” Jamie’s father and grandfather were stockbrokers at Shearson. With two brothers—Peter and a twin named Ted—Dimon graduated from the Browning School, then headed to Tufts University, where he studied psychology and economics, graduating with highest honors.

During his studies, he wrote a paper on Shearson’s mergers, which impressed Sandy Weill enough to hire him for a summer position. Dimon then worked two years in management consulting before being admitted to Harvard Business School, earning his MBA as a Baker Scholar in 1982. Weill convinced him to join American Express rather than pursuing roles at larger investment banks.

Career

Commercial Credit and Transition into Citigroup

When Sandy Weill left American Express in 1985, Dimon joined him in acquiring Commercial Credit. Dimon took on the CFO role at just 30, contributing to a significant revival of the company. The subsequent mergers and acquisitions led to the creation of a major financial institution: Citigroup. Dimon, however, exited Citigroup in late 1998 after a disagreement with Weill, which reportedly began over internal promotion issues and requests for Dimon to be treated as an equal.

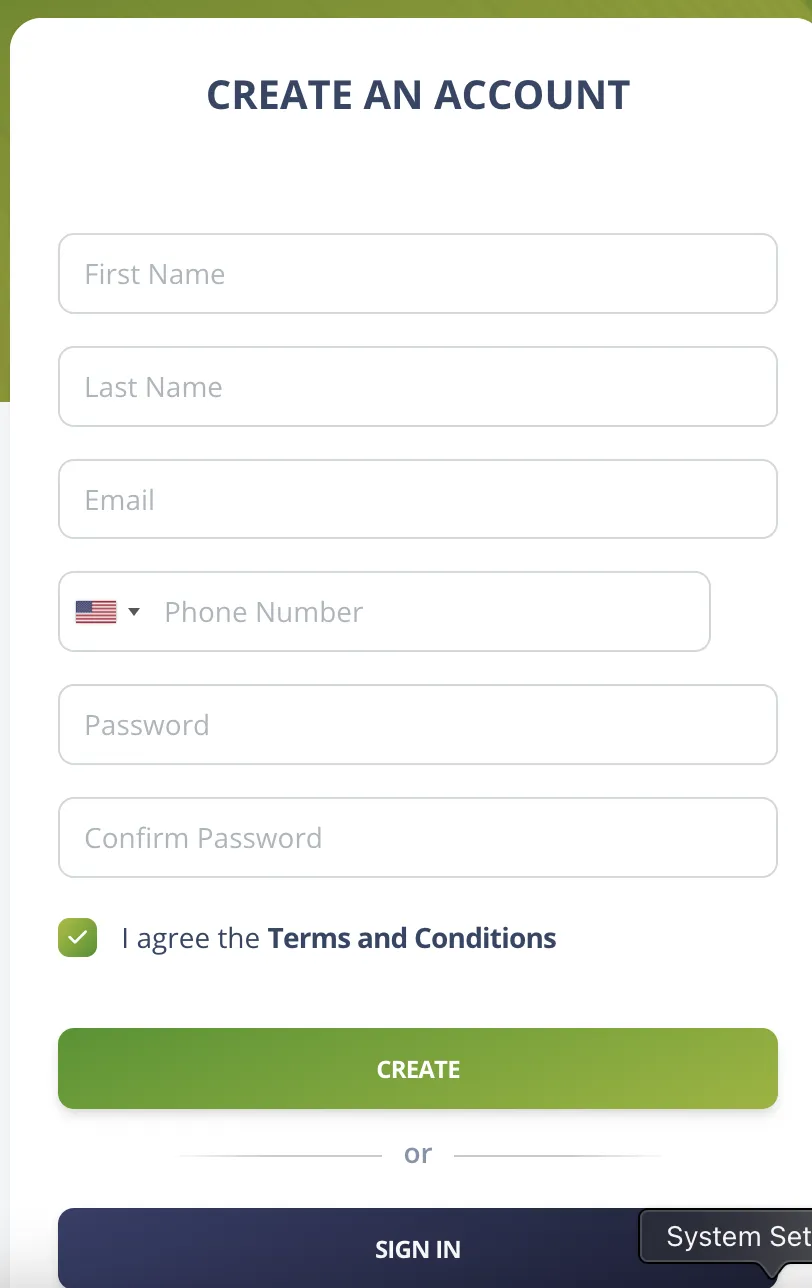

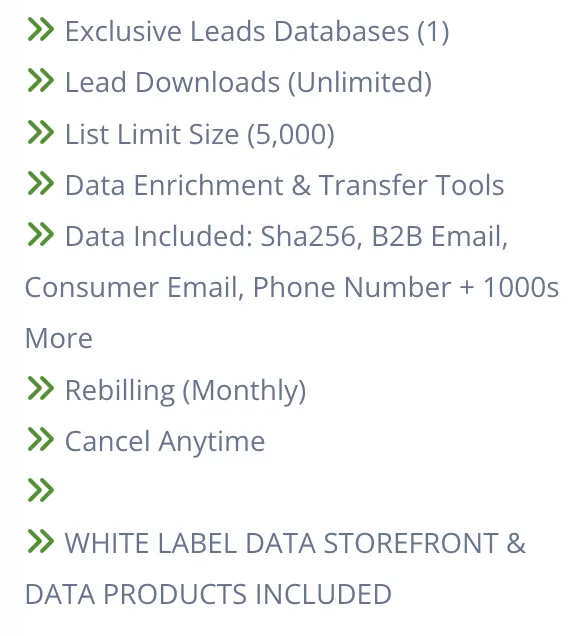

Create Free Account - Get Free Leads

Move to J.P. Morgan

Dimon became CEO of Bank One in 2000, steering it until its merger with JPMorgan Chase in 2004. He then moved up to president and COO of the merged firm, became CEO at the close of 2005, and added the chairman title in 2006. In 2008, he was named a Class A board member of the Federal Reserve Bank of New York. Under his oversight, JPMorgan Chase expanded substantially to become a leading U.S. financial institution. He gained notoriety in 2011 for accusing the Basel III regulations of being biased against U.S. banks. In 2012, JPMorgan reported a multibillion-dollar loss involving complex trades intended to hedge credit exposure, famously attributed to the “London Whale.” Federal agencies began investigations around the incident.

In May 2023, Dimon provided testimony in lawsuits targeting JPMorgan Chase due to its relationships with Jeffrey Epstein. Dimon and the bank denied the allegations, describing them as unfounded. He serves on the executive committee of The Business Council and sits on the Business Roundtable, having held chair positions in both organizations.

Fines and Legal Settlements

While Dimon has led JPMorgan Chase, the institution has faced more than $30 billion in total fines for a variety of infractions, including a record $13 billion settlement over pre-crisis mortgage-backed securities. Dimon criticized the agreement as unwarranted, stating that most infractions occurred before JPMorgan purchased Bear Stearns and Washington Mutual at the behest of government officials during the 2008 financial meltdown.

Compensation

Dimon is among the few bank CEOs to reach billionaire status primarily through shares of JPMorgan Chase. In 2011, he earned $23 million—higher than any other U.S. bank CEO that year. However, his 2012 compensation was cut in half after a series of trading mishaps. By 2013, it was raised to $20 million thanks to strong corporate earnings. In 2022 and 2023, his compensation stood at $34.5 million and $36 million respectively, reflecting the bank’s ongoing profitability.

Approach to Business

Dimon is known for constantly carrying notes of tasks, reminders, and items to follow up on, crossing them off systematically. He has mentioned employing the OODA loop (observe–orient–decide–act) in corporate decision-making.

Political Activity

Historically, Dimon supported the Democratic Party, although he later described himself as “barely a Democrat.” Some speculated he might join Barack Obama’s cabinet, but Timothy Geithner ultimately became Treasury Secretary. Dimon has challenged certain Obama administration policies while endorsing others. During the 2016 Brexit vote, JPMorgan Chase contributed to the Remain side, with Dimon making public appearances alongside British officials.

He joined Donald Trump’s business advisory council but parted ways after controversy surrounding the 2017 Charlottesville rally. Though he backed Trump’s 2017 tax reforms, Dimon has criticized the federal response to COVID-19. Calls emerged in 2023 for him to run for president, but he’s indicated no current interest. Late in 2024, media reports claimed Dimon privately endorsed Vice President Kamala Harris’s presidential run, yet after Trump’s return to office in 2025, Dimon aligned with his tariff measures despite earlier cautioning about their economic impact.

Personal Life

Dimon married Judith Kent, his Harvard Business School classmate, in 1983; they have three daughters. In 2014, he was diagnosed with throat cancer and underwent radiation and chemotherapy. He also required emergency heart surgery in March 2020 to address an acute aortic dissection. By April of that year, he had resumed work remotely, with other senior executives temporarily overseeing JPMorgan Chase’s day-to-day operations.

Awards and Honors

- Inducted into The Browning School’s Athletic Hall of Fame (1994)

- Golden Plate Award from the American Academy of Achievement (2006)

- Recognized as International Executive of the Year by The Executives’ Club of Chicago (2010)

- Included in the National Association of Corporate Directors Directorship 100 (2011)

- Received the Intrepid Salute Award (2012)

- Gold Medal from Americas Society (2016)

- Conferred France’s Legion of Honour (2022)

References

Several references in the original text mentioned official filings, press releases, and reputable news outlets like The New York Times, The Washington Post, and statements by Dimon during interviews or testimony.

External Links

Related content can be found through official JPMorgan Chase press releases, major financial news platforms, or archived interviews featuring Jamie Dimon.